Guide to Flipping NFTs

Hello and welcome to flipping NFTs in 2022, where you can make more in one day, than most make in a month. This is the day and age we live in and its fairly easy (but risky).

I have been flipping things all my life, so I am having the time of my life this year flipping different NFTs. If you are not a flipper, then I would def tread the waters carefully. You can learn, but it takes time. I don’t know how to explain it, but when you’ve been flipping for years, you learn different sales tactics.

Some are easy to explain and some just come naturally / can’t really explain it. The simplest one I can think of is posting something for 0.999eth rather than 1 eth. 0.999 looks cheaper. Even though it’s basically the same price.

Your listing for 0.999, is going to come before and sell usually before all the 1eth listings. Same thing goes for selling things on ebay, listing it for $99.99 is better than posting for $100.

It’s all a sales tactic that deals with human behavior. There are tons of other things that you learn in years of flipping that comes naturally. This makes it much easier. I will try my best to explain when it comes to NFT flipping though.

I’ll walk you through step by step how I personally look for flips. If you are new learn the basics of NFTs. Then, please proceed with caution and start small (0.2eth or less projects).

THIS IS FOR FLIPPING / BUYING IN GENERAL – VERY IMPORTANT STUFF

Step 1- Confirming a bull / good market to buy in:

Always make sure you are in a bull market / a market that is up trending. There are many different sites you can use to check the volume of NFTs. Usually you want to just check Opensea sales/volume, but getting the NFT markets volume as a whole works too, I use nft-stats.com or Nonfungible.com/market/history or dune.xyz/rchen8/opensea .

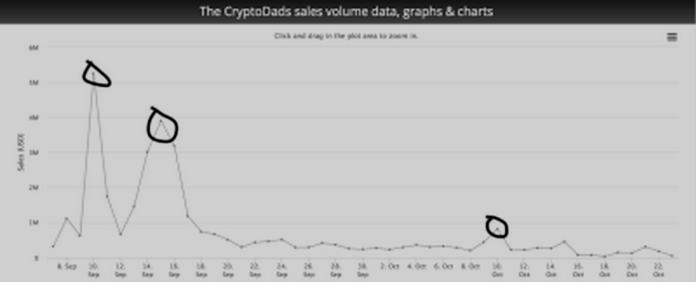

Using multiple different sites and looking at charts to find the tops of bottoms is key. As you can see in the image below, right now it looks as if the market has bottomed out. You want to wait for a big volume bar for the next day, maybe even wait for two for confirmation. You never want to buy the top and you never want to guess a top or bottom, because it can keep going or it can keep dipping, wait for a confirmation.

Aug 15th-21st would have been the perfect buying opportunity. You can see a peak / resistance towards the end of August. If you look at the 2nd week of September, it hit a key support and held (perfect buying opportunity). Then you can see the uptrend again, all the way to the end of September/Early October when the market hit its peak.

About October 3rd it hit an all-time high and has been regressing ever since. It’s gone so low we’re actually close to what the volume was in July before we even went on this massive NFT craze that we’ve been on the last few months. A couple of bigger people in the space have called today (10/23) the bottom and have been buying up a lot of things. Me personally, I’ll wait for more of a confirmation before I ape back in. This is all a perfect example of what you’re first looking for.

Step 2- Choosing the best projects for flipping NFTs:

If you have Nansen, then you can see a lot of good info to analyze a project to see many different indicators that can confirm it is a good buy. Since this is more of a beginner guide though, you can check out cryptoslam for charts since its free. The most basic thing to look for is you don’t want to buy a top. I made this mistake when I first was starting out.

1st picture: When a project first mints it goes crazy. I almost never buy a project the first few days / week no matter what. When a project first comes out there is so much hype and this pushes the price up as everyone that couldn’t mint, FOMO’s in. You can look at ANY chart 9 times out of 10 it will look exactly like this. Never buy the top, wait for the hype to die down.

2nd picture: This is a zoomed in version of the first chart, this is where you start to strategize and analyze. The line I drew is a very solid support line, usually this is better used when look at a chart for the projects average sold price on Nansen, but sales works too.

As you can see this project is at an all time low, this is because of the bear market, but mostly because they allowed to you mint a CryptoMom if you held your CryptoDad, so it really crashed the price. None the less the chart is just like the NFT market as a whole right now (pretty close to bottomed out). Your risk to reward ratio is good enough right now to start looking to snipe.

Step 3 – Actually buying:

Method 1: FINALLY THE GOOD STUFF. I’m not going to lie, when I first started flipping NFTs for flipping your NFTs. I did not do Step 1 or 2. As I’ve been in the space though, I have realized that the NFT market is kind of like the stock market in terms of Technical Analysis.

Now it’s time to go to rarity.tools . Once you find your project then search for it. If you don’t have any clue what project to buy, then actually go to rarity tools or crypto dunk first and look at the hottest selling projects the last 24 hours or better yet 7 days.

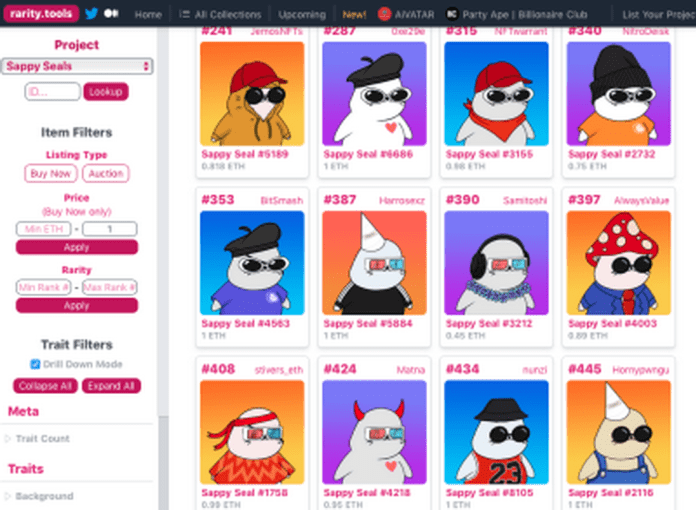

When I first started flipping NFTs, I only had like .2 eth, so I could just go down the top projects on rarity tools and look for a project with a cheap floor. For this example, we’re going to pretend we have 1 ETH. I searched through a few projects and would put 1 ETH max price of the left side and scroll through and look for outliers. If you look at this picture below, it is so obvious what the outlier is.

If you didn’t see that the #390 rarity seal was the outlier, than you’re NGMI (Not gunna make it), kidding. That’s why I made this guide, to help people that aren’t use to flipping.

Now think of a price you believe you could resell it at…… I’ll wait….. If I were to resell it, the perfect price would be .69 ETH, no pun intended lol. If you wanted to be greedy or if you didn’t want a quick sell you could sell for .79 since the one at #241 is at .81 eth.

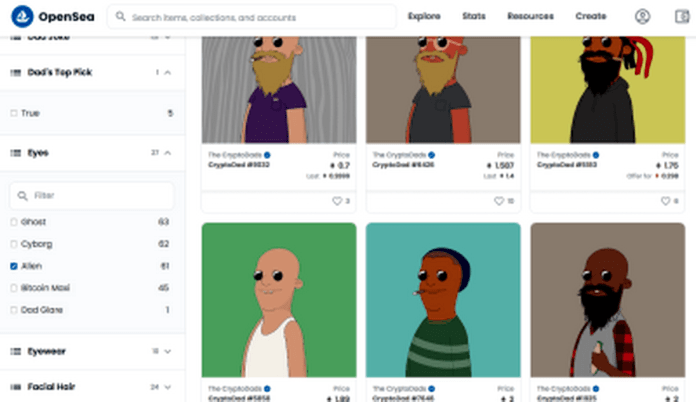

Method 2: Another way to snipe listing is to sort by traits. You can do this on rarity tools or just go to the collection on Opensea. Go to the traits, go to each category and scroll all the way down so you see the traits that have less than 100. For this example, I used “Eyes” as the category and “Alien” as the trait.

There are only 61 with this attribute which is perfect. The ones that have very few would be much more expensive and much less liquid. You can see the price discrepancy between the lowest listed one at .7 and the next one up at 1.58 eth. The one at .7 is pretty good too since it’s not that far from the floor price (which is 0.55).

I’d buy this and sell for 0.99eth since I know there is going to be a big price wall at 1 ETH. Using this trait tactic, you usually don’t worry about floor price of price walls, but I’m just sharing my exact thoughts. You could definitely try to sell this for 1.29-1.49 ETH.

You also want to see what other people have bought theirs at. This isn’t too much of a factor, but if using this tactic, it’s something you want to look at. For example, if the owner of #6426 and #5183 bought theirs for say .4 and .5 respectfully, then I might not buy #9032 because the other guys might undercut me since they paid way less.

Method 3: This is the most time consuming, but most cost efficient & also will get you the most profits. Everything that has said before pertains exactly to this, you will just be trying to low ball them / get a better deal.

It just involves making many offers on ones that interest you.. Next, you will have to wrap your ETH to get WETH. You can do this easily in your meta mask or an easier, sometimes cheaper way is to make an offer on something. You then just click “Convert ETH”. After you converted your ETH you can start making offers.

This also saves you on gas fees which can be .02-.03 (close to $100). Seems too good to be true? Well, it lowkey is because it will usually take a while before someone bites and accepts your bid. If I had to estimate, I’d probably say less than 5% of my bids get accepted (Less than 1 out of every 20).

It is very time consuming, but if you are a bargain hunter or starting off with very little ETH, then you got to do what you got to do. I actually use this tactic on the higher priced projects. For example a 4 ETH offer isn’t that far from 4.5 ETH (~11% less).

But sending in an offer of 0.5 ETH on a listing that is 1 ETH is 50% less, no one’s going to go for that. Therefore, don’t even waste time with that much of a low-ball offer.

Below are some great sites to use, check them out, find what suites you.

Rarity.tools

Cryptoslam.io

Niftyriver.io

Icy.tools

Nansen.ai – (best tool out there, but have to pay for)

Nonfungible.com/market/history . – (great tool to look at market volume)

dune.xyz/rchen8/opensea . – (great tool to look at market volume)

nft-stats.com – (great tool to look at market volume)

Thanks to Bangstabears for the guest article;

Discord: https://discord.gg/Qs6cNnNUQS

Twitter: https://twitter.com/BangstaBears

Instagram: https://www.instagram.com/BangstaBears/

Website: https://bangstabears.com/

Source: NFT News Today

---------------------------------------------------------------------------

Are you tired of missing important NFT drops? Just check out our NFT Calendar! Receive the biggest NFT news of the day & recommendations in our Daily newsletter.

- All of our news is being sent daily on Telegram

- We summarize the biggest news daily on Twitter & Instagram

- Learn with video tutorials and subscribe to our Youtube Channel

All investment/financial opinions expressed by NFT cable are not recommendations. This article is educational material. As always, make your own research prior to making any kind of investment.